The beginning

The videogames arrived in Brazil in a period when the importation of information technology products was restricted by law, as a way to foster the domestic production through a market reserve . So, the ownership of a videogame console was rare and a reason to bring friends home to play.

The first game console sold in Brazil was Telejogo, a Pong clone that Philips started producing in 1977. In the 80s, some Atari clones were produced in Brazil, like the Dactar by Sayfi and the Dynavision by Dynacom.

In 1983, the Atari 2600 enters the market, officially licensed and produced by Polyvox . Other Atari clones were the CCE Supergame and the Dismac VJ-9000, among others. In 1984, there were already more than 20 videogame cartridge factories in Brazil. Some games were sold only in Brazil as Pizza Chef and Xevious, by CCE. After that, came the clones of Nintendo and Sega videogames.

In 1986, the first personal computers begin to enter the Brazilian market – as the MSX, TK90X and TK95 – and they brought games that did not require the consoles, leading to a decline in their production by local companies.

The industry

We can say the Brazilian games industry is starting the transition from childhood to maturity, leaving behind the romantic phase and taking into consideration the requirements to succeed in the global game business ecosystem. Nowadays more companies are acknowledging that beyond making a great product it is mandatory to consider the importance of creating sustainable business models, choosing the right distribution channels and publishing partners, selecting the adequate monetization methods, negotiating with seed money and venture capital investors, to name just a few challenges.

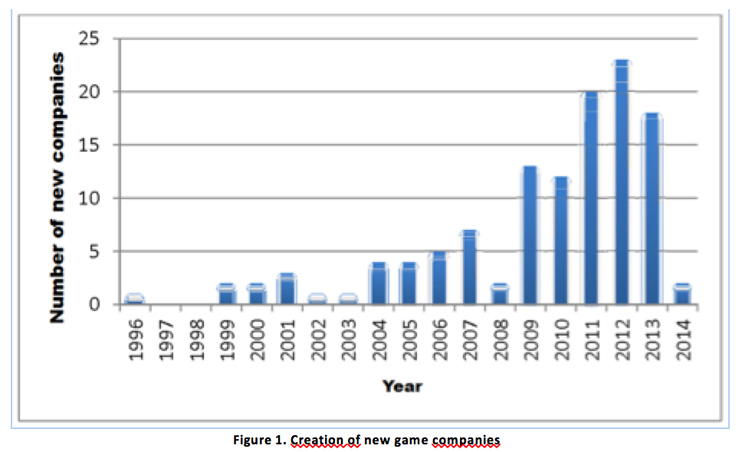

According to the mapping of the Brazilian and global digital games industries , published by BNDES and USP, in 2013, Brazil was already the 4th largest consumer of digital games in the world, ahead of the United Kingdom, Germany and Spain. The sector comprises essentially micro and small companies, many still in the learning phase, working in isolation in most cases, which does not allow the obtaining of needed scale to sustain the investments in innovation. The study found 133 active game studios, 73.4% of which had up to 5 years of operation, and of these, 52.6% had up to three years. The increase in the number of new game studios after 2009, as shown in the next figure, may be related to a conjunction of facts: the lower barrier of entry in the games development for mobile and web platforms; the availability of powerful and easy to use development tools like Unity 3D; and the growing adoption of broadband Internet, worldwide.

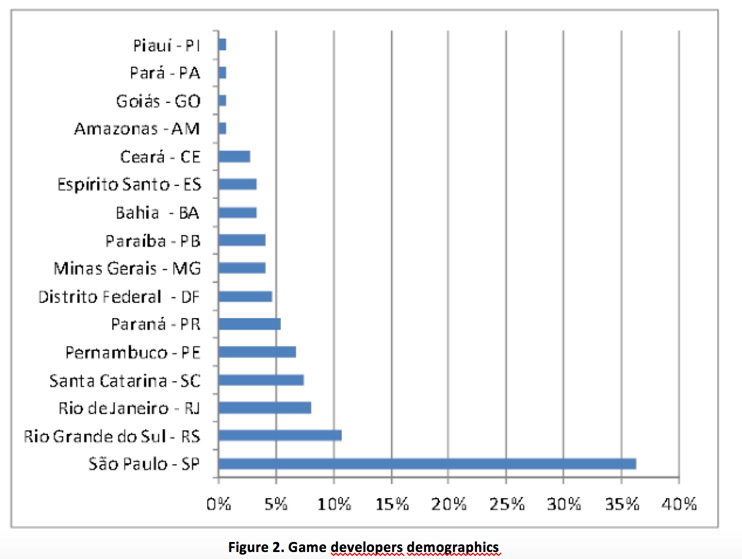

Circa of 75% of the companies had yearly revenues below R$ 240.000,00. Most companies operate in São Paulo, Rio Grande do Sul, Rio de Janeiro and Santa Catarina, in Southern and Southeast regions. An exception in the Northeast region is Pernambuco, occupying the fifth position, as shown in the figure bellow.

The development of advergames and serious games as well as custom simulations, are generally hired locally. Although important to the development of industry and survival of many studios, this service orientation makes it difficult to achieve growth and increased profitability. On the other hand, the entertainment market is attractive due to its high scalability and potential profitability, but it involves more risks and demands greater investments.

The imported games dominate the Brazilian market. According to Oliver Römerscheidt, director of GFK , "Far Cry" was the third franchise with more sales of games in December 2014, in Brazil, second only to 'FIFA' and 'PES ". Giving a perspective to the game market figures, Oliver mentioned that the total game sales in Brazil in 2014 was R$ 10 million.

The market

An Ibope 2011 survey points that 54% of the Brazilian Internet users played online and 23% played games on social networks . Another Ibope survey, in 2012, points that of the 80 million Internet users, 61 million played some kind of game, and of these, 67% uses consoles, and 42% used personal computers, especially to play online games.

The 2012 survey shows that online players devoted a daily average of 5 hours and 14 minutes playing games, compared to the average of 3 hours and 22 minutes spent by players using desktop and portable consoles. 47% of players were women, 51% of which (12 million people) belonged to the class A and were aged between 40 and 49 years. Among female casual gamers, 59% played every day and preferred card games. Women among 25- to 35-year-olds spent more time on casual games in social networks such as Facebook applications, accounting for 60% of revenues from social gaming.

The same survey reveals that among the 61 million users playing games on computers, 43% access gaming sites; 40% download Internet games; 42% use computer embedded games; and 18% play games through console emulators.

The TIC Kids Online Brasil survey interviewed children and teenagers aged among 9 and 16 years, and showed that 54% of them have played digital games alone or with other people on the Internet and 17% have already experienced virtual worlds. According to the survey, 35% of children played daily; 45% played once or twice per week; and 19% played once or twice per month. In terms of social class, 63% of those children belong to classes A and B, 50% to class C and 44% to classes D and E.

The growing adoption of cell phones and smartphones has been democratizing the access to the Internet and to the online digital games. In 2009, 78.5% of Brazilian households had mobile phones compared to 43.1% that had a landline telephone . While 6.8 million smartphones and 20.5 million feature phones were sold in the first semester of 2012, in the third quarter of 2013, 10.4 million of smartphones and 7.5 million of feature phones were sold.

Serious games

Beyond the entertaiment oriented games some companies and institutions develop serious games or “games with a purpose”. Serious games can be defined as games that aims to learn or practice concepts and skills, in areas as Education, Health, Defence, Marketing (advergames), Social Inclusion and Empowerment.

In Brazil, the development of serious games has strong links with universities and research institutions which usually receive funding for R&D from main national funding agencies as FINEP and CNPq – both linked to the Ministry of Science, Technology and Innovation (MCTI), besides State funding agencies, as FAPESP, FAPESB, FAPERJ, FAPEMIG and FAPESC.

Continue reading Mapping Brazil - Games: Gamification