In addition to significant international awards, 2009 saw the beginning of a boom period for the industry driven by ongoing development initiatives and measures taken by ANCINE from 2001 onwards, with a favourable period for Brazil's economy too. Public-sector investment rose and its scope was broader and more diverse since, in addition to production, policies provided more funding to support the distribution and exhibition segments too. The agency's initiatives broadened to include television, which is not within the scope of the present article.

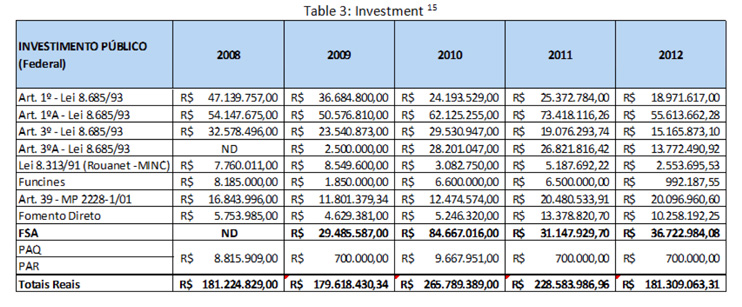

Before 2002, public funding for audiovisual production had consisted almost entirely of tax incentives under the Rouanet Law and the Audiovisual Law's articles 1 and 3. Fortunately, new forms of support known as 'additional revenues' and 'quality incentives' were introduced. In both cases, amounts are awarded automatically based on takings earned by full-length features as well as artistic aspects; Film-industry investment funds (Funcines) are eligible for tax breaks and there are 'special promotional programs' (locally known as PEFs) with articles 1A and 3A to support television productions. In 2009, adding to the above, the Fundo Setorial do Audiovisual (Audiovisual Sector Fund) - FSA covered several links in the supply chain: production, distribution, sales and marketing, exhibition, and infrastructure for services. The following table shows how funds from these programs have been used:

The Audiovisual Sector Fund (FSA) is allocated federal budget funds from a tax levied on the industry's own revenues, known as the Contribuição para o Desenvolvimento da Indústria Cinematográfica Nacional (Contribution to Development of the National Film Industry) – CONDECINE, plus revenue from concessions and licensing, in particular the Fundo de Fiscalização das Telecomunicações (Telecommunications Oversight Fund) – FISTEL, which have grown fast and boosted the Fund's revenues. FSA revenues have risen drastically since 2012 to their current level of around R$ 1 billion. With more capital, the fund was able to further broaden its coverage in 2013. Now it has signed partnership agreements with states and municipalities as well as development agents such as Brazil’s Banco Nacional de Desenvolvimento Social (Economic Development Bank) – BNDES and the Banco Regional de Desenvolvimento do Extremo Sul (Southernmost Region Development Bank) – BRDE that acts as FSA's financial agent.

In addition to public-sector investment, other indicators of the Brazilian cinema industry were of interest in the 2009-2014 period. In 2010, director José Padilha's Elite Squad 2 broke Brazil’s cinema history records with over 11 million viewers nationwide, beating the previous record held by Bruno Barreto's Dona Flor e seus dois maridos (Dona Flor and Her Two Husbands) in 1979. Box-office totals for Elite Squad 2 combined with those of two religious-themed successes – Nosso lar and Chico Xavier – reached over 25 million viewers, making 2010 one of the best years ever for Brazilian cinema. Comedies too stood out during this period and some have established franchises while the genre's strong local market share will be shown by the 2015 releases of local blockbusters such as Minha mãe é uma peça 2 and Meu passado me condena 2 [literally, "My Mother is a Piece of Work 2" and “My Past Condemns Me 2"].

Box-office numbers for Brazilian titles have held up well over the years to reach higher levels as of 2013, with 129 titles on release in theatres. Together with this number, admission revenues during the same period have risen to almost R$ 2 billion.

In 2011, international films screened in Brazil earned approximately US$ 858 million, which surpassed Mexico to make it Latin America's biggest market in terms of box-office takings. On the industry’s worldwide ranking, Brazil was 14th for revenue and 10th for total tickets sold in theatres.

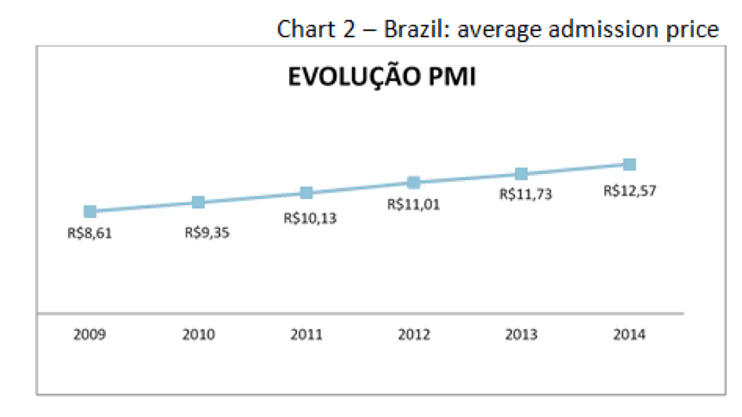

Even at this favourable time for Brazilian cinema's growth, one cannot help but notice that the cinema format has long been extending beyond its own barriers and moving away from theatres. Home video and cable television have been seizing business opportunities posed by full-length feature films for decades. This trend took on yet more momentum as the Internet grew and offered opportunities to monetize digital media. Although home video has always been a comfortable means of access, watching great films on TV screens was a very limited experience a few decades ago when compared with the huge screens and sound facilities of theatres. But the rising availability of electronics such as TVs and home theatres has greatly enhanced the screen quality of domestically available content. This together with growing supplies of digital content means that home entertainment is very competitively priced compared with going out to a cinema. Theatres too have been undergoing a process of modernization over a number of decades. Exceptionally high-quality image and sound provides a unique experience for viewers willing or able to pay for tickets. Yet, this has become an increasingly expensive pastime.

All these aspects, taken together with the dynamics of the Brazilian economy over the last few decades, have prompted Brazilian cinema makeover as it tracks the international trends set mostly by U.S. studios. Theatre seating capacity has been reduced while ticket prices have been rising over the last few decades through partnerships with malls and other forms of entertainment.

ANCINE's data show that Brazil had almost 3,300 theatres in 1975 and the total dropped to a low point of just over 1,000 in 1997. Over the last ten years numbers have risen consistently to reach 2,830, of which 1,770 were digital by 2014.

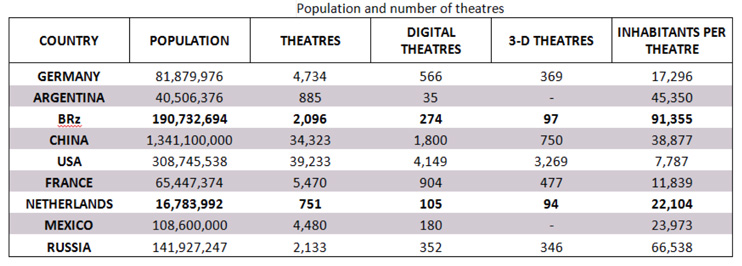

Despite this significant improvement, Brazil is still lagging behind the potential posed by the size of its population. Less than 8% of cities have a theatre. Taking 2009 as baseline, Brazil's theatres / inhabitants ratio compares with other countries as follows:

These numbers prompted a public-policy focus on screening venues and the Audiovisual Fund (FSA) devised its Cinema Perto de Você (Cinema Near You) program to cover this aspect.

More recently, new content distribution initiatives have sought to leverage the trend to digitize and reconfigure theatres. Some theatre chains are exploring different ways of screening classic films or exclusive content that would have tended to go directly to cable TV or one-demand outlets, which shows that there are opportunities in the theatre market too.

As to the home entertainment industry, Brazil’s market also has room for further growth. Under Law 12.485, cable TV channels must screen a certain proportion of Brazilian content, which has boosted the industry in terms of both acquiring content and new productions. In this regard, the major producing countries have already taken on the major challenge of digitizing entire holdings of films and other content. Current production is digital from the outset, but the great majority of the abovementioned Brazilian classics, for example, are not yet available in digital format. The body taking decisions on this issue is the Ministry of Culture-subordinated entity Cinemateca Brasileira, whose archives of features, shorts and newsreels hold about 200,000 reels, as well as a large collection of books, magazines, original scripts, photographs and posters. So, distribution for this Brazilian content is also a field to be explored. Even with the new law, there is room for Brazilian films to grow their market share locally and internationally, but this will mean finding new ways of engaging with the digital market.

Public policies have also made a huge contribution to grow cross-border markets for Brazilian films. New ways for films and industry professionals to engage with international markets have arisen in recent years through subsidies and agreements and protocols signed between institutions in different countries.

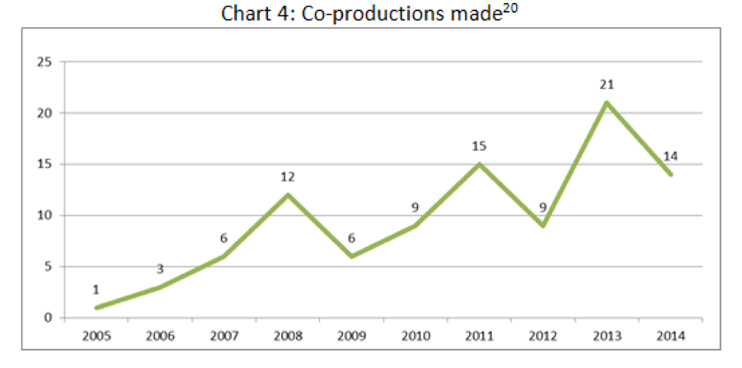

Increased availability of support enabling international festival curators to come to Brazil has led to a favourable context for international co-productions. The proliferation of audiovisual events has prompted more opportunities for interchange not only between institutions organizing them, but also between professionals and audiovisual works. All five regions in Brazil hold film events that involve international dialogue and offer partnerships with enhanced exchange opportunities.

Return to Mapping menu